Ethereum is the second-largest cryptocurrency by market capitalization rate, and as such, it is often the second blockchain-based project lawyers research after Bitcoin.

The Ethereum project is often an exciting revelation of blockchain technology’s applications, especially after becoming familiarized with the basics of what Bitcoin has to offer.

To sum things up, Bitcoin was created as a decentralized peer-to-peer cryptocurrency. It uses a distributed global ledger called the blockchain to ensure transactions are verified accurately, and the network is maintained.

Now, Ethereum is similar in that it uses blockchain, but it differs in that it does so much more than just be a means of sending someone money. Sure, you can send someone the ether (ETH) equivalent of $1,000 (about 0.35 ETH at the time of writing) the same way you can send someone $1,000 worth of BTC, but you’d be glossing over Ethereum’s greatest functionality.

Think of Ethereum as a smartphone with an app store, on which any developer can launch an application, provided they meet the standards set by the Ethereum community.

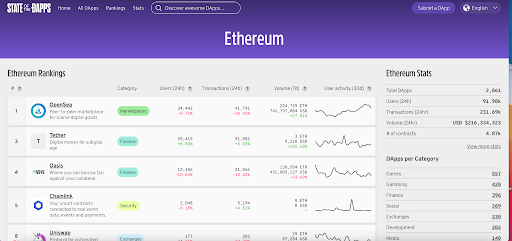

Ethereum essentially made a blockchain that anyone can build on top of; rather than building their own blockchain, independent developers can just build on the Ethereum network. This platform, called the Ethereum Virtual Machine (EVM), has been used to launch over 10,000 decentralized applications (dApps).

To give you a better idea of what Ethereum is actually used for:

The NFT marketplace OpenSea, a startup recently valued at $1.5B, is largely built on Ethereum (although it supports other chains, but we’ll get into that later.)

Tether, a stablecoin pegged to $1, is built on Ethereum; it is the largest of its kind, with its market cap (USDT) nearly at $70 billion.

Uniswap, a protocol designed for decentralized peer-to-peer token swapping and a key facet of the decentralized finance (DeFi) universe, is built on Ethereum.

Axie Infinity, a blockchain-based game in which fierce little cartoon creatures battle it out, is built on Ethereum. Its token, AXS, has a market cap of over $4.3 billion.

So, outside of the developer, financial, and consumer applications, Ethereum has one feature worth the attention of any lawyer– smart contracts.

Ethereum: Quick Facts

The Ethereum blockchain is a public, permission-less blockchain with many of the same technological components of Bitcoin’s: cryptographic hash function, decentralized P2P network, private and public-key encryption, and a Proof-of-Work consensus algorithm.

Ethereum’s native coin, Ether, has the second-highest market cap and is one of the fastest-growing digital assets to date. Projects that launch on Ethereum utilize their own native token (to be distinguished from the term “coin,” as coins have their own blockchains.)

Ethereum allows users to specify how much computing power should be spent on a transaction– a measure of processing power termed “Gas.” If a transaction can be accomplished within a specified limit, it would be executed– if not, the changes are reverted. Simple payments are fairly low-computation processes and require less gas, whereas the more complicated operations like minting an NT (or deploying a smart contract) require more gas.

Gas fees have been a fairly controversial topic in the cryptocurrency community. Since thousands of decentralized applications use Ethereum’s blockchain, the network can get congested in moments of high activity, and gas fees can shoot up astronomically.

For example, on a quiet day in 2021, gas fees could cost about $5 to send someone some ether or about $40 to purchase an NFT on OpenSea. However, in busier times, it’s normal to see gas fees of $80 to $200 to send a payment, or even in the thousands to purchase an NFT!

Ethereum has multiple network upgrades in motion that focus on the scalability of the project. However, this hasn’t stopped competing networks like Binance Smart Chain from simply copying the Ethereum idea and making adjustments to prioritize cheaper transactions.

Enter the Smart Contract

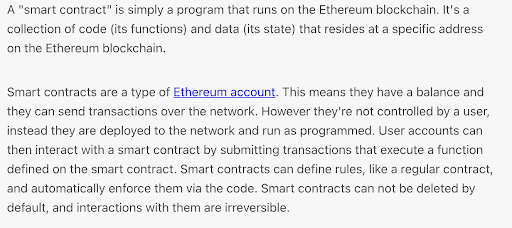

Smart contracts are pre-programmed contracts that allow for the execution of specific legal functions once certain criteria are met. For example, a smart contract could specify that a set amount of cryptocurrency tokens will be automatically transferred or sold if a required condition is met.

Smart contracts on Ethereum use Ethereum’s proprietary language called Solidity. The Ethereum developer handbook defines smart contracts as “a type of Ethereum account. This means they have a balance, and they can send transactions over the network. However, they're not controlled by a user; they are deployed to the network and run as programmed. Smart contracts can define rules, like a regular contract, and automatically enforce them via the code. Smart contracts can not be deleted by default, and interactions with them are irreversible.”

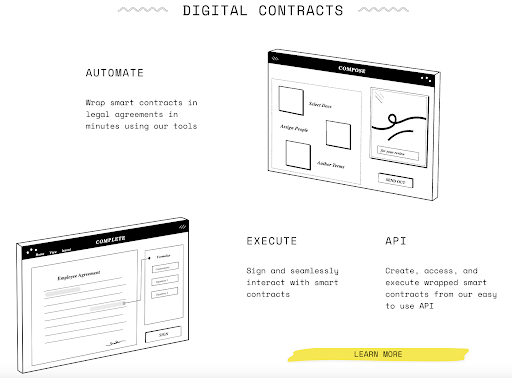

(Blockchain startup OpenLaw focuses on making smart contracts easier for a mainstream audience)

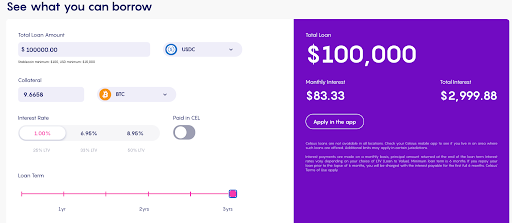

In practice, the decentralized lending industry utilizes smart contracts to collateralize and issue loans seamlessly. Platforms like BlockFi and Celsius lend out cryptocurrencies to people who apply and have collateral for them– one can get a $100,000 loan at a 1% interest rate by placing about 9.6 BTC as collateral (about $400,000.) These cryptocurrency interest accounts also pay users for holding their cryptocurrency on the platform. The companies make money on the difference in borrowing and lending rates, similar to a traditional bank.

However, many of these loans are based on smart contracts. Does the person have the collateral? If so, issue the loan. Is the person paying their interest payments? Has the person returned their principal and paid their interest? All of the questions that would otherwise need a human, or multiple humans, to approve can be handled by the smart contract, which executes automatically.

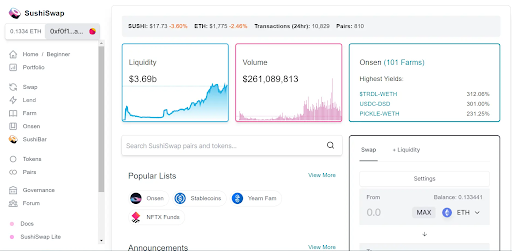

Ethereum even allows for the complete removal of the centralized entity (BlockFi or Celsius, in this case). DeFi ecosystems like SushiSwap make it possible for users to lend and borrow from each other without ever knowing who the other party is– with no human being involved in the transaction whatsoever.

Another great example of smart contracts is the mechanism underpinning prediction markets.

Ethereum-based prediction market platforms allow people to create custom smart contracts based on the potential future outcome of an event. For example, we could create a smart contract to allow people to bet on who wins the 2029 NBA Finals.

People would send Ether (or that prediction market’s token) to a wallet outlined in the contract. Once the 2029 Finals conclude, and the winner is set (likely to be confirmed by an oracle specific in the contract), the winning parties would receive their tokens and winnings into the wallet address they specified when they entered the contract.

How Do You Build an Ethereum dApp?

Decentralized applications built on Ethereum must meet the token standard for which they aim to qualify.

For example, most tokens on Ethereum are ERC-20, a standard for Fungible Tokens (every token is exactly the same as the others). 1 Basic Attention Token (BAT) will always equal 1 BAT.

Ethereum also specifies ERC-721 tokens, which are Non-Fungible Tokens (the NFTs you’ve likely heard so much about). NFTs are unique items that are unlike others, like a song, picture, or deed for a house.

Generally, dApps must meet the following criteria:

- The code must be fully open-source;

- The token and project must operate autonomously;

- The application needs to use a cryptocurrency token;

- No single entity can control the majority of the cryptocurrency tokens (it cannot be a centralized project);

- The future changes of the app must be determined by a consensus of users;

- The data the project stores must be stored in a decentralized blockchain, not a central database, and it must meet cryptographic standards;

- The token must use a standard cryptographic algorithm, such as Proof-of-Work (POW), to generate new cryptocurrency tokens.

Final Thoughts: Why Ethereum Matters for Lawyers

Blockchain, especially in the form Ethereum-focused developers are applying it, stands to revolutionize a wide variety of industries, and law is at the forefront.

Legal services like Rocket Lawyer and Legal Zoom are already experimenting with blockchain smart contracts. Rocket Lawyer’s Rocket Wallet product, for example, bills itself as a “legal contract execution and payment on the Ethereum blockchain” and has partnerships with ConsenSys (a Brooklyn-based Ethereum project investment firm and incubator) and OpenLaw (a startup working on smart contracts for mainstream audiences.)

However, Ethereum is not the end-all-be-all for blockchain and law. Multiple Ethereum competitors are in the wings, each attempting to offer a unique value proposition to lure innovators and developers into building on their platforms. In addition to Ethereum, projects like Cardano, Polkadot, and Solano are all projects with substantial implications for the legal industry.

If you’re eager to learn more about the Ethereum project, we highly recommend reading through the Ethereum developer documentation and immersing yourself in the ecosystem– even just developing a minute literacy on the topic will likely help serve you for years to come.