Cryptocurrency: What Lawyers Should Know

Cryptocurrency, or “crypto,” is a digital currency that can be used to purchase goods and services. It is defined by four distinct characteristics; cryptocurrency is:

- Entirely virtual– there are no physical bitcoins.

- Trustless– parties must be able to transact without the need or enforcement of an intermediary.

- Immutable– cryptocurrency transactions are permanent and cannot be reversed or altered.

- Decentralized– this virtual currency is held within the blockchain network but not controlled by a central bank or banking institution.

The world’s first cryptocurrency, Bitcoin, was launched in 2009 by a programmer (or group of programmers) operating under the pseudonym Satoshi Nakamoto. Originally introduced in the 2008 whitepaper, A Peer-to-Peer Electronic Cash System, Nakamoto’s invention paved the way for over 9,000 different cryptocurrencies. We highly recommend reading through the whitepaper to better understand the cryptocurrency movement.

Cryptocurrency is viewed as a great disruptor of legacy systems, and the legal industry and financial sector are at the forefront.

The following article explores what cryptocurrency is, how it works, and why it’s relevant for you.

Why Cryptocurrency?

Why Cryptocurrency?

A key attribute of cryptocurrency is that it is decentralized, meaning it lacks a centralized hub. There isn’t a single individual point of failure– one network cannot be hacked, one office can’t be targeted. This inherently makes a decentralized system more secure, or at least more difficult to attack, than a traditional payment system.

Cryptocurrency can function 24/7/365, and if it is completely decentralized, it’s incredibly difficult to shut down.

Cryptocurrency enables a fully functional peer-to-peer environment, and by its design, it cuts out middlemen intermediaries (such as banks and payment processors) that process transactions for a fee.

Ardent cryptocurrency supporters view cryptocurrency as a technological upgrade to an outdated inefficient financial system, often pointing to the inefficiencies and corruption that serve to benefit those who hold power and wealth at the bereft of those who do not.

Bitcoin, for example, has ideological ties to the 2008 Housing Crisis and American monetary policy in aggregate. Social and wealth inequality movements like Occupy Wall Street, Libertarianism, cryptography, and Cryptopunk communities have grown in considerable popularity in the past few decades.

A decentralized cryptocurrency competes with centralized fiat currency, removing the need for central bank controls. Such an idealistic system aims to give people direct control over their wealth without a third party being involved in any way– from storage, purchase, transaction, or creation.

As such, cryptocurrency such as Bitcoin is hailed as a grassroots movement. Anyone around the world can participate, and the network is entirely maintained by volunteers who are incentivized by the network’s rewards.

Alongside (or despite) its ideological roots, the cryptocurrency movement is also supported by a myriad of interests, running the gamut from technologists and enthusiasts to traders and speculators.

While cryptocurrencies may seem more sci-fi than realistic, some of the technology underpinning their actual utility has been around for decades.

Early cryptographers like David Chaum (“Blinded cash” and DigiCash in the ‘90s) and Nick Szabo (Bit Gold) were early pioneers of decentralized peer-to-peer currencies, but it wasn’t until that 2008 Bitcoin whitepaper when the cumulative inventions of digital cryptographically supported money received significant momentum.

If you find yourself melancholically longing for tangible paper greenbacks, it may surprise you that only 8% of the world’s money is physical, 92% only exists digitally. Digital currencies have existed long before Bitcoin– but cryptocurrency as we know it is little over a decade old.

How Cryptocurrency Works

Let’s start with arguably the core technology of cryptocurrency, the blockchain.

The blockchain acts as a digital ledger that keeps track of every transaction and verifies every party owns what it owns, and thus, can send it to another party.

The blockchain replaces the need for a centralized agency to verify transactions and maintain the integrity of the network. The blockchain prevents double-spending and verifies the authenticity of each transaction.

Each block in the chain is a collection of transactional data, such as Person A sent an amount of cryptocurrency to Person B, Person C received an amount of cryptocurrency from Person D, and so on.

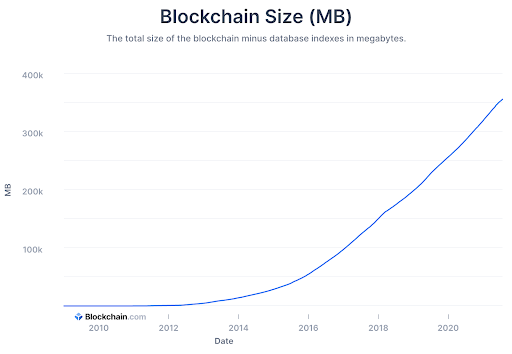

Bitcoin, for example, has blocks that carry up to 2MB of transactional information, and they currently carry around 2,500 transactions. The entire Bitcoin blockchain is about 355 MB.

Each block is connected to the one before it. Think of a mosquito trapped in amber– each new layer of amber makes it increasingly more difficult to dig and reach the mosquito. The deeper the block is, the more it is ingrained in the blockchain’s permanence.

Granted, even new transactions added are permanent, but reversing an older transaction would require the potential reversal of every transaction afterward, which is a nearly impossible task. Hackers would not be able to change one block in the ledger but would have to reproduce the entire chain.

So, who determines what blocks get added, and which ones are fraudulent? Network participants are welcome to take on the responsibility to uphold the blockchain by “mining”.

These miners operate computers that carry out sophisticated calculations (per Bitcoin’s consensus algorithm, “Proof-of-Work”) to determine the validity of a specific transaction. Thousands of miners across the world must agree that a transaction is valid. This helps curb the double-spending risk.

Miners are incentivized to maintain the blockchain by block rewards and network fees. The first miner to add a block receives a block reward of 6.25 BTC, or about $210,000. The Bitcoin mining reward “halves” every few years, ensuring all of Bitcoin’s 21 million coins are produced in a long-enough timeline.

The confirmed blocks create a chain, a linking that references each prior block.

Bitcoin mining, in particular, has received its fair share of criticism for being highly energy intensive. Approximately 0.2% of the world’s electricity powers Bitcoin miners. Most Bitcoin miners use between 60% to 80% of what they earn from the blockchain to cover their electricity and computing costs.

Different blockchains use different consensus algorithms. Some, for example, use Proof-of-Stake, which allows users to “stake” their coins for a profit and help validate transactions.

How to Use Cryptocurrency

So, if you’ve made it this far, you may want to breathe a sigh of relief– using cryptocurrency is nowhere near as complicated as understanding how it works!

You store cryptocurrency in a cryptocurrency wallet, conveniently named to conjure up the image of storing dollars in a wallet. Since crypto is 100% digital, there aren’t actually coins to store anywhere.

So, what are we protecting?

A cryptocurrency wallet protects your private key, which is like your secret password that tells the blockchain you are the owner of your funds, and you can send them to anyone anywhere. If someone gains access to your private key, they can do as they wish with your funds– so keep your private keys safe?

The cryptocurrency wallet interacts as software with the blockchain and allows users to receive and send cryptocurrency. This wallet also provides you with a public key, which is a public-facing address where anyone can send you money.

Well, how do we buy cryptocurrency in the first place?

You can buy cryptocurrency from a cryptocurrency exchange, ATM, or direct peer-to-peer transfer. Exchanges are most popular and convenient because they offer built-in wallets. However, custody of your funds is very important, and we dive into it further in our cryptocurrency wallet guide.

Similarly, if you wish to convert your Bitcoin back into USD or other fiat, you can do so through an exchange, or “off ramp.”

So, what happens behind the scenes of a cryptocurrency transaction?

When you buy or sell cryptocurrency, you authorize the movement of a specific amount of crypto from their wallet address to the seller’s wallet address. Depending on their wallet or exchange interface, you copy and paste the other user’s public key, enter the amount you wish to send, and press send.

The transaction is signed by your private key, encrypted, and pushed to the blockchain. From here, the network’s miners access the public key associated to confirm that a private key was used to encrypt the transaction.

Once the block that includes this transaction is confirmed, the blockchain’s mechanism is updated to reflect new cryptocurrency balances for the buyer and the seller’s addresses. All of this is done completely digitally and by computer software.

Blockchain technology gives everyone a copy of each transaction and uses the blockchain to ensure that each user’s copy remains the same. This process is transparent throughout.

Types of Cryptocurrency

The most popular and valuable cryptocurrency is Bitcoin; it is regarded as the flagship cryptocurrency, and has the strongest adoption rate among users and miners. It’s a peer-to-peer cryptocurrency with one function, sending money between users.

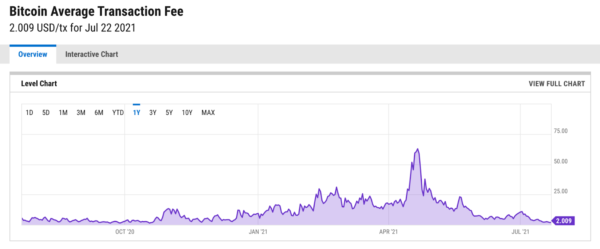

The entire process is decentralized, and anyone can send any amount anywhere at any time, for minimal network fees. These fees go to compensate miners, and run anywhere between a few dollars to $75 determined by the network’s activity. In theory, one could send $1,000,000 to their friend across the world for less than $5, and the process would take anywhere between a few minutes to a few hours.

Ethereum is another popular cryptocurrency. Proposed in 2013 by 19-year-old developer Vitalik Buterin as a means to expand the functionality of Bitcoin. Ethereum is more than just a means to transact– third-party developers can build powerful decentralized applications on top of its blockchain that can do anything from smart contracts, non-fungible tokens (NFT), social media, platforms, and decentralized finance tools. Each action on Ethereum costs some of the native token ether (ETH).

Privacy coins are a cryptocurrency type that power anonymous and private blockchain transactions, hiding the identities of both users. While Bitcoin and non-private blockchains allow users to view public addresses and transactions in their network, privacy coins complicate this transparency.

Stablecoins are anchored to other stable assets, like government-issued currencies, like the U.S. dollar. An entity behind the stablecoin will set up a reserve where the asset backing the stablecoin is stored. The money in the reserve serves as collateral for the stablecoin. For example, a user could set up a $100,000 reserve that backs up 100,000 units of the stable coin.

Final Thoughts

Many companies, entrepreneurs, and lawyers are beginning to see a unique future in cryptocurrency.

Dozens of large enterprise organizations such as IBM have moved to incorporate the blockchain into their business offerings.

Hundreds of startups have moved to launch their own tokens and coins, aiming to decentralize and disintermediate popular unicorn startups.

Even entire governments are exploring launching blockchain-based digital currencies.

If you’re a lawyer reading this, your brain might be spinning for all the opportunities. To put gas on the fire, the cryptocurrency industry is vastly underserved by lawyers, and it is in dire need of competent individuals to help pioneer the cryptocurrency revolution.