In just ten years, the flagship cryptocurrency Bitcoin has garnered a wide range of prominent and notorious monikers:

Bitcoin is...the future of money, Internet drug money, the future of the financial industry, a speculative bubble, a global currency, a direct threat to the U.S. Dollar, a looming environmental disaster, to name a few.

An often completely unprecedented legal situation exists at almost every twist and turn in the cryptocurrency industry. There are few spaces that are in such dire need of competent legal guidance while simultaneously being at a lack of legal talent.

The Legal Examiner cryptocurrency crash course aims to change that, starting with educational overviews on topics such as this one– what actually is Bitcoin?

Bitcoin is a cryptocurrency designed specifically for peer-to-peer transactions. Most notably, Bitcoin is completely decentralized, meaning that there is no central entity responsible for the issuance of new bitcoins, which are created per the project’s programming in a process called mining.

Most cryptocurrency newcomers tend to get confused by Bitcoin for one primary reason: a deep look at Bitcoin often provokes a deeper look at our traditional finance system, which can be a fairly murky endeavor.

Subtracting the technical jargon and industry lingo, Bitcoin attempts to make transparent what is otherwise opaque.

Bitcoin: A Brief History

Bitcoin was first outlined in a 2008 whitepaper created by Satoshi Nakamoto, a pseudonym for a mysterious individual or group of individuals. We highly recommend reading this whitepaper in detail as it’s one of the only documents released as close to the source of Bitcoin as possible.

Bitcoin’s mysterious founder is still a topic of speculation, as no one truly knows who Satoshi is, or even whether he or she is still alive. Nakamoto suddenly appeared in 2008 and disappeared in 2011, sending his final communication, a farewell email to another Bitcoin developer, on April 23, 2011.

Speculators have attempted to link Nakamoto’s identity to a handful of potential people:

- The late Halley Finney was a pre-bitcoin cryptographic pioneer and the first person to use the bitcoin software and improve the technology. Finney passed away in 2014.

- Nick Szabo is a Hungarian-American programmer, decentralized currency enthusiast, and a creator of a Bitcoin precursor called “bit gold.” Szabo has denied he is Satoshi Nakamoto.

Bitcoin officially launched in 2009. Regardless of its creator, Bitcoin has evolved to become the first and most popular cryptocurrency asset, reaching a peak total market capitalization of nearly $1.2 trillion in 2021.

Bitcoin was originally created to be a decentralized peer-to-peer cryptocurrency, where anyone anywhere in the world can send any amount of BTC to a receiving party for a minimal price. No central party dictates whether a transaction is eligible to go through or not– the transaction’s validity is simply decided by the network.

If both BTC addresses are valid, the sender has the amount of BTC available to send, and they “sign off” the transaction with their private key, the transaction will go through without a hitch. If any part of this isn’t accurate, the transaction won’t go through. Worse, if the BTC is sent to an invalid address, it will be irreversibly sent into the metaphorical abyss.

This, perhaps, is one of the more daunting aspects of cryptocurrency like Bitcoin; it’s a final settlement layer.

Most people aren’t used to transacting at a “layer one” digital financial settlement layer, where any money moved is essentially irreversible, or in Bitcoin’s case, completely irreversible. We’ve grown accustomed to being able to dispute credit card charges at the click of a button. There isn’t a “Bitcoin office” you can call if your transaction doesn’t go through.

“Being your own bank” comes with great responsibility.

Enter the Blockchain: Why and How

The blockchain is the technology that makes a decentralized cryptocurrency like Bitcoin possible; it helps verify the transfer of funds between two parties and prevents the double spending of money in a transparent manner.

Think of the blockchain as an infrastructure-level technology that makes it possible to completely disintermediate systems in which a third-party intermediary facilitates the flow of money or information.

In Bitcoin’s example, the blockchain disintermediates a central monetary authority, such as the Federal Reserve System. The Fed determines the amount of money in the economy using techniques like quantitative easing, a tactic that increases the U.S. money supply by purchasing assets with newly-minted bank reserves to give banks more liquidity.

Cryptocurrency proponents point to the fact that the Fed primarily consists of an appointed, rather than elected, group of individuals capable of taking actions that reduce the value of an individual’s personal wealth. With inflation tracking up to 5% per year, Americans (and international holders of the U.S. dollar) can expect their fiat wealth to be worth 5% less per year– a family with $200,000 in the bank would, in theory, lose $10,000 every year.

Adding fire to the gunpowder of an arguably inefficient Central Banking system and national debt rapidly rising about $28.3 trillion was a handful of instances where the government took action that was perceived as misaligned with the interests of its constituents.

The 2007-2008 Financial Crisis saw many American citizens and internationals lose collective billions of dollars either directly or indirectly caused by the Crisis, which was tightly linked to the actions taken by big banks participating in the sale of collateralized debt obligations, synthetic CDOs, and sub-prime mortgage lending.

Rather than being jailed, as many grassroots movements like Occupy Wallstreet advocated for, bank executives were given golden parachutes, and many of their banks were bailed out, with money printed by the government, even more at the expense of the average citizen.

There is no coincidence that Bitcoin’s whitepaper, launched in 2008, rapidly gained momentum with a cohort of tech-savvy, Libertarian-leaning individuals at its core.

The blockchain has three core attributes; it is:

- Immutable. In theory, no one can tamper with the data added to the blockchain once it is confirmed and added.

- Decentralized. Blockchains such as that of Bitcoin aren’t maintained by a single centralized entity but rather are distributed among a global network. This enables the network to escape the vulnerabilities that come with a centralized system.

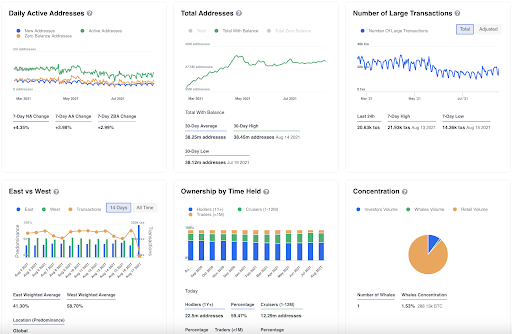

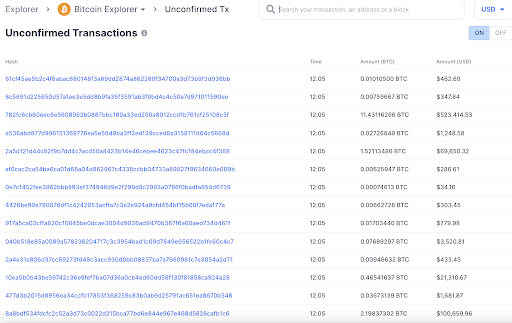

- Transparent. If a blockchain is public and permissionless (there are also private, permissioned blockchains often used by enterprises), anyone can see transactions added in real-time and can look up any transaction in the past. A Bitcoin blockchain explorer, for example, showcases all recent transactions, newly mined blocks, and other granular statistics like Daily Active Addresses and Ownership by Time Held.

A quick look at a blockchain explorer gives you a peek under the hood of a fully functional, independent financial system– data that is often obscured behind layers of complexity and interconnected parties.

How to Buy Bitcoin

Buying Bitcoin is a relatively straightforward process. However, it can seem daunting without a minimal familiarization of cryptocurrency basics, like what is a cryptocurrency wallet or how a cryptocurrency transaction works.

The simplest way to buy Bitcoin (or another cryptocurrency) is from a cryptocurrency exchange. There are hundreds of exchanges around the world, and it’s important to pick one that you trust.

In the United States, exchanges like Coinbase, Gemini, and Kraken have excellent reputations built over nearly a decade. Coinbase and its alternatives offer what is called a fiat on-ramp or a place where you can trade fiat (U.S. Dollars) for cryptocurrency (Bitcoin). They also offer a fiat off-ramp, where you can trade your cryptocurrency back into the U.S. Dollars– just be aware that you may cause a tax liability when doing so, as per the U.S. tax code.

On a cryptocurrency exchange, you simply make an account and provide all the legally required KYC/AML information.

Once your application has been approved (usually under 5 minutes), you can deposit USD into your account and exchange it for cryptocurrency. Most exchanges charge a fee for the service, which can get up to about 3% of the purchase price.

Coinbase, for example, is a simplified user experience that has been used by millions of cryptocurrency beginners but charges some of the higher-end fees in the industry. However, its “pro” product, which is free and with a more robust user experience, offers the same cryptocurrency on ramp for a fraction of the fees.

How to Store Bitcoin

Most cryptocurrency exchanges come with built-in cryptocurrency wallets. Once you’ve purchased the Bitcoin, it will automatically be added to this wallet in the exchange.

This is a generally low-risk practice with small amounts of cryptocurrency. Still, it’s worth mentioning that your funds are potentially at risk in the unlikely situation a cryptocurrency exchange gets hacked. Cryptocurrency is not FDIC insured, so if you lose your BTC, there is limited recourse.

Alternatively, you could elect to store your Bitcoin on your own cryptocurrency wallet, which our How to Store Your Crypto guide dives into greater detail.

Why Are There So Many “Bitcoins?”

As you progress along your cryptocurrency journey, you’ll start seeing many coins with similar names or attributes.

Bitcoin. Bitcoin Gold. Bitcoin Cash. Bitcoin Platinum. Litecoin. The list goes on.

The important thing to know is that there is only one Bitcoin (BTC)– every variation of it was produced by a third party as a “fork” of the original project.

Specifically, a fork is a new project that splits off the original blockchain at a specific point in the chain.

With a soft fork, only one blockchain remains valid, and the network is forced to update to the new rules.

With a hard fork, a new blockchain and entirely new coin are created.

Take Bitcoin Cash (BCH), for example. In August 2017, the Bitcoin community was split on a few issues, mainly the block size of blocks to be added to the blockchain. One camp defended Satoshi’s original vision of smaller block sizes, whereas the other advocated for larger block sizes that would make Bitcoin transactions faster and cheaper.

Tensions rose to the point that the larger block size camp launched an aggressive campaign to “hard fork” Bitcoin, and in August 2017, Bitcoin Cash (BCH) was created as a hard fork of the original blockchain.

All BTC holders received an equivalent amount of BCH after the fork, and there was a temporary drama between both communities regarding user and miner adoption.

Bitcoin (BTC) held onto its throne, and today, BCH is considered to be a smaller cap altcoin– far from its ambitions of replacing BTC.

Final Thoughts: Bitcoin for Lawyers

If you are a lawyer considering entering the cryptocurrency world, Bitcoin is an excellent place to start.

Not only is its narrative grabbing for those who enthusiastically follow financial and legal history, but its practical applications in society are also becoming more commonplace by the day.

There are many twists and turns ahead for Bitcoin. Lawyers would be keen to sharpen upon not only the flagship of cryptocurrency but the hundreds of other coins and thousands of other tokens in the ecosystem.