In October 2021, the first tokenized lawsuit fund went live on Republic. Termed an “Initial Litigation Offering,” the tokenized effort is aiming to fund a case against a California county. Tokenholders of the lawsuit token will receive a stake in the resulting recovery, if any.

Now, things are moving so quickly at the intersection between cryptocurrency and law, so by the time you read this article, the story might be outdated– but note, this article is written to explain the fundamental moving blocks surrounding the case so you can better evaluate future happenings in the industry.

Here’s what you need to know.

Enter the Law Firm

This Initial Litigation Offering “ILO” is an initiative by the law firm Roche Freedman LLP. This firm is also representing the estate of David Kleiman in a case against Craig Wright. In short, the trial revolves around whether the late David Kleiman worked in partnership with Craig Wright in the creation of Bitcoin.

Wright claims he is the human behind the pseudonym Satoshi Nakamoto, and as such, owner of a wallet with an enormous fortune of bitcoins. The cryptocurrency community largely views Wright’s claims as fraudulent, but still, the Australian computer scientist persists.

This case is one of the most significant cryptocurrency legal cases in courts yet and has been anticipated for years.

Roche Freedman LLP is also active in a wide swath of class-action suits against token issuers such as Binance, BitMEX, Civic, Tron, KuCoin, Bibox, Kaydex, Status, and Quantstamp.

Enter the ILO

Being at the forefront of many clashes within the cryptocurrency ecosystem, Roche Freedman LLP is experimenting with an Initial Litigation Offering for the Apothio, LLC v. Kern County, California case.

In short, the plaintiff, Apothio LLC, is seeking up to $1 billion in damages; it’s claiming the Kern County's Sheriff Department destroyed its hemp cropland in 2019 under the notion that Apothio’s hemp crop exceeded the bounds of its legal THC allowances.

So, let’s suppose Apothio LLC doesn’t have the capital that is generally required to fund a lawsuit of this caliber. Similar to an initial coin offering, the ILO would allow virtually anyone (institutional or retail) to buy into the lawsuit and receive a stake in the results.

In comments to The Block, Founder and Partner Kyle Roche was adamant in his confidence that the future of funding legal affairs through ILOs because it fits within the SEC’s crowdfunding landscape with ease.

“It’s maybe not enough for every company looking to raise capital, but a $5 million cap is perfect for this,” commented Roche.

The ILO tokens aren’t governance tokens, so investors don’t have any rights over decisions or actions in the case.

Enter Republic

Republic is a platform that has built its reputation for tokenizing what are usually inaccessible investments for a retail user base.

In regards to the SEC crowdfunding landscape: many of Republic’s offerings involve exemption from full registration with the assertive Securities and Exchange Commission. ILOs would operate under the more lenient crowdfunding exemption, allowing for the public to invest up to a generally low threshold.

The ILO, which launched in late October 2021, is seeking $5 million in investment in Republic.

Enter Avalanche

The Avalanche blockchain is the creation of Ava Labs; it markets itself as an incredibly fast, open, programmable smart contracts platform for decentralized applications.*

*Editor’s note: If you’d like to dive deeper into blockchain platforms and smart contracts, we recommend checking out our guide on Ethereum and smart contracts.

The Ava Labs actually pioneered the concept of an ILO in unison with US law firm Roche Cyrulnik Freedman LLP and Republic Advisory Services in late 2020.

In a press release announcing the ILO, Ava Labs pointed to LexShares, a leading litigation fund, generated a median annualized return (after fees and expenses) of 52% since it began investing in litigation in 2014 with the return coming from over 100 cases.

Participants in this specific ILO would have to create Avalanche wallets to receive their tokens. Since Avalanche is a blockchain-based smart contracts platform, the distributions would likely happen automatically, with no central entity determining who gets paid and who doesn’t– the smart contracts are pre-programmed to automatically distribute funds when specific criteria are met.

Final Thoughts: Welcome to the Tokenization of Litigation

From afar enough vantage point, funding litigation finance and venture capital look strikingly familiar– both are essentially an arms race to battle against a myriad of forces, where the probability of success but the returns tend to be outsized.

However, everyday people have never really been able to access the upside of litigation finance, for better or for worse. The arena of litigation finance has remained a private area of investment to the extent that most people don’t even think it’s possible to invest in future lawsuits.

The ILO essentially allows any retail investor to put their money behind cases they wish to support, for purpose or for profit, and directly benefit in the upside. Plaintiffs that are otherwise unable to raise funds now have an opportunity to raise the capital through crowdfunding efforts.

The private field of litigation is projected to reach $20 billion in annual revenue by 2026, a figure that may be drastically different if this primarily private field is opened up to everyday investors.

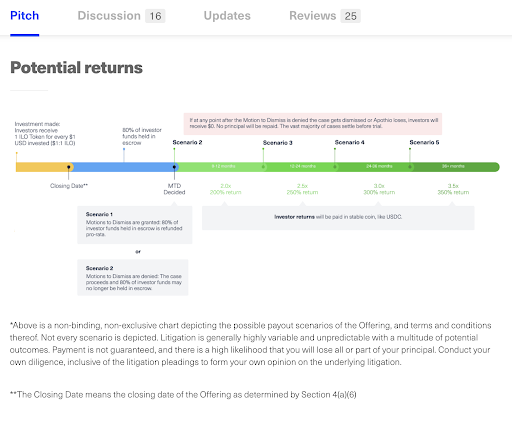

In summation, the Apothio, LLC v. Kern County, California case will be the first ILO in action. The ILO is aiming to raise $5 million. If the court dismisses the lawsuit, ILO token holders get 80% of their money back.

If the court accepts the lawsuit, the token holders will either get between 2x and 3.5x returns (contingent on the timeline of the judgment of settlement); if the plaintiff loses, token holders lose the full value of their tokens.

This 2x to 3.5x multiple raises eyebrows, as the case is seeking up to $1 billion in damages; the full amount is about 200x greater than the capital being raised. We recommend diving into the formal listing on Republic to decipher on your own.