An NFT, or “non-fungible token,” is a token that represents a unique, digital item that exists on the blockchain.

If that sentence sounds like a bunch of cryptocurrency industry jargon to you, don’t fret– we’ll unpack every component below.

Token. To understand NFTs, you should be somewhat familiar with what a cryptocurrency coin or token is in the first place. In a nutshell, a token is a digital asset that exists on the blockchain, the ownership of which is proven by who holds the private key to the wallet that contains that token.

The blockchain is a decentralized digital ledger that keeps track of who owns what and ensures all transactions are valid.

Fungibility. Most tokens like DAI, ChainLink (LINK), or Compound (COMP) are fungible, meaning there is no difference between 1 LINK in my wallet and 1 LINK in your wallet. Dollar bills, technically, are also fungible, since their value is identical to one another.

Now, a “non-fungible” asset is one that is completely unique, even among its category.

-

- Tickets. Is a ticket to courtside seats at the NBA finals as valuable as a ticket to seats in the nosebleed section? No.

- Art. Is a Rembrandt worth the same as a reproduction on the same size canvas? No.

When you think about it, the vast majority of “things” are non-fungible. It’s the fungible items that are a rather new invention.

All NFTs do is offer the technology to offer all the benefits of the blockchain (decentralization, ability to prove provenance, portability, etc.) to both digital and physical items.

NFTs are currently being used to represent things like collectibles, digital art, game items, domain names, event tickets, and even the ownership records for physical assets.

The following article explores what NFTs are, how they work, examples of popular use cases, and what they mean for lawyers.

Why NFTs?

NFTs carry data that specifies anything from a .JPEG, MP4, or .PDF of a contract on an immutable blockchain. This blockchain can’t be tampered with, so someone simply can’t jump into an NFT and start changing things around.

Whenever an NFT exchange happens (I sell you my Cool Cat NFT), the transaction is added to a new block, which is then confirmed and added to the blockchain with the information of the new owner, you. The chain of transactions on the blockchain makes it possible to seamlessly track the ownership of a single digital asset throughout the entire duration of its existence.

The following features make NFTs an impressive innovation:

Verifiable: Anyone can verify the authenticity of a digital asset, even if it has been traded hundreds or thousands of times. Think of an electronic, decentralized, always-accurate with no room for error, house title deed.

Indestructible: An NFT can’t be destroyed because it’s electronic and it exists on the blockchain. Someone can’t tamper with the blockchain and delete the .JPEG of a CryptoPunk. However, there are exceptions, such as someone losing their wallet with all of their NFTs (it happens.) Digital decay is also a concern, as all digital storage is prone to experience some breakdown or degradation over a long period of time.

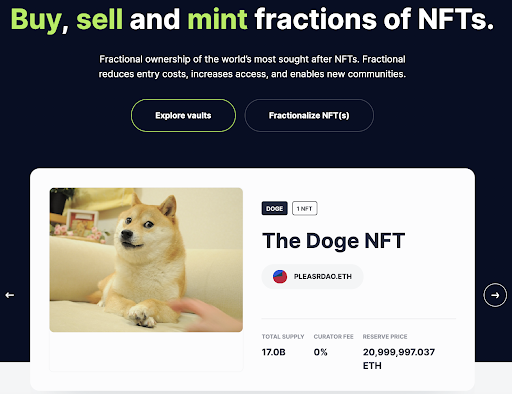

Indivisible: An NFT can’t be broken down into sub-assets; in the same way, you can’t cut up the Mona Lisa into squares and assume they will retain the same value. However, you can be a “fractional owner” of an NFT, where many different people share a percentage of the ownership of the NFT through other mechanisms. One such service, for example, is fractional.art, a platform on which people buy other tokens (not NFTs) that represent the ownership of a single NFT.

Use Case #1: Digital Art and Collectibles

In 2017, if you would have told almost anyone, even most people in the cryptocurrency community, that a CryptoPunk, an 8-bit avatar, would go onto be considered a “digital antique” and sell for over $7 million just four years later, you would likely have been deemed insane.

But that’s exactly what happened.

CryptoPunks, a collection of 10,000 uniquely generated characters on the Ethereum blockchain, were initially given out for free to anyone with an Ethereum wallet in 2017. As the first NFT of its kind, CryptoPunks were a pivotal innovation that unveiled a movement: people wanted to “own” digital art, and simply saving the image to their computer isn’t enough.

An NFT proves who owns what; a CryptoPunk holder is instantly verified as such by the blockchain.

Punks were the predecessors to a slew of “profile picture” NFT projects, like the Bored Ape Yacht Club (BAYC), Cool Cats, and Robotos– all of which have become popular as profile pictures on Twitter among cryptocurrency, tech, and venture capital crowds.

Brands are even getting in on the action– Visa even bought a CryptoPunk for about $150,000.

Use Case #2: Real Estate

If you’ve ever purchased property or even just rented an apartment, you likely faced a few complexities you may have felt didn’t really need to exist.

There are plenty of examples to choose from: from meeting with a property manager in an Olive Garden to sign a lease and receive the keys to spending weeks dealing with multiple parties to validate the deed of a property.

NFTs can streamline the ownership of physical real estate and potentially help disentangle a myriad of traditionally inefficient processes.

Let’s assume you want to sell your house. You would need a title deed document to prove you actually own the house. If you misplaced it or the record can’t be found online, you may find yourself enmeshed in legal complexities and disputes that would extend the house selling processes by weeks, months, and sometimes, years.

An NFT can represent land, buildings, or even rooms in a house, helping to track the ownership and authenticity of a property on the blockchain. Also, similar to how NFT art ownership can be fractionalized, an NFT of a property can be fractionalized to have multiple owners, helping to create liquidity in an otherwise rather illiquid position.

For example, Propy is already utilizing NFTs for real-estate transactions.

NFTs can also be for virtual land ownership, as seen with projects like Decentraland.

Use Case #3: Intellectual Property

Intellectual property and patents, as intangible as they are, rely on the existence and maintenance of databases, which inevitably require some human component to ensure the proper functionality of, as well as proper information retrieval.

The issue with this model is that traditionally many centralized databases can be inefficient or otherwise insecure. In theory, a centralized database as a central (or multiple core) points of failure.

In contracts, the blockchain is decentralized, so information on it, such as IP and patents, is spread over thousands or tens of thousands of nodes around the world, each of which has a copy of the blockchain and consistently validates new transactions and updates the blockchain.

If you’re interested in learning more, we recommend checking out IBM’s collaboration with IP ecosystem platform called IPwe. This project aims to tokenize patents so their owners can trade them on accessible and liquid marketplaces.

Final Thoughts

NFTs are of interest to a wide variety of audiences, and as such, they attract a wide variety of proponents. For one, NFL player Julian Edelman even wrote an NFT guide on popular NFT marketplace OpenSea.

Among other NBA and NFL stars, NBA All-Star Steph Curry is an owner of a Bored Ape Yacht Club NFT, graphically designed apes that regularly sell for six to seven figures.

However, with all the celebrity power that NFT art and collectibles have gained over the past year, it’s important not to overlook how NFTs serve to disrupt a wide variety of industries, including law.

It’s seemingly inevitable that forward-thinking organizations will start to dabble in tokenizing assets, a process that will likely need strong regulatory and legal guidance as well.