Decentralized Finance, “DeFi,” is a technological movement towards cheaper and open access to financial services (such as borrowing and lending) by eliminating or reducing the costs and risks that comes with centralized intermediaries such as banks.

In line with the decentralization ethos of cryptocurrency, DeFi aims its innovative scopes at traditional financial sector silos, seeking to disintermediate the complexities and powers of centralized financial entities.

However, DeFi has its fair share of challenges in its attempts to fulfill its ambitious mission.

The following article explores the conceptual drivers of the potential and risks of DeFi, and what anyone seeking to gain literacy in this rapidly developing ecosystem should keep in mind.

A Deeper Look at DeFi

DeFi is an amalgam of various platforms and protocols aiming to replicate existing financial services, using some sort of cryptocurrency or blockchain to do so.

Contrary to the industry’s name, the projects in DeFi aren’t completely decentralized. Still, they do share a few commonalities: limited centralization, open & permissionless, interoperable with other projects, and often built with the goal of plugging into other DeFi smart contract platforms.

In essence, there isn’t a single company that aims to become (or at least has a dominant hold on) the one-stop shop for all things decentralized finance. (yet)

Think of the present DeFi ecosystem like a wide array of interoperable LEGO pieces:

A non-custodial Ethereum wallet app like MyEtherWallet connects with a decentralized lending system like Aave, where users can be paid interest to lend crypto, as well as borrow crypto. Similarly, they can connect an Ethererum wallet like MetaMask to a decentralized exchange (DEX) like Uniswap and swap between various token pairs.

All of the above functions are done on an automated, interoperable, and decentralized ecosystem through smart contracts– no human approval or guidance is needed.

When we conceptualize the DeFi lasagna, we look at four core elements:

- A public base layer with a digitally native token (i.e., AAVE, UNI, COMP, etc.)

- An open-source software protocol that codifies the agreed upon rules (“how to integrate with our service”)

- Smart contracts that implement the financial logic and execution of transactions once specific conditions are met.

- Stablecoins that are backed by reserves held at banks (or algorithmically determined.)

Since DeFi protocols are deployed on a public blockchain, users can monitor all transactions and interactions transparently. As such, an entire army of “yield farmers” has emerged, seeking to find outsourced gains on lending pools across various protocols and tokens.

The Risks of DeFi

This is by no means a comprehensive list of all risks associated with DeFi. Still, it’s not much of an overgeneralization to claim most of DeFi’s risks are rooted in the decentralized nature of the blockchain.

On the one hand, DeFi offers to automate the execution of financial services and reduce dependencies on humans. From what we’ve seen in its nascent stages, it accomplishes this fairly well. The disintermediation of traditional intermediaries reduces high fees and the barriers to entry, passing the value to participants.

However, the absence of centralized intermediaries also reduces oversight and control, which have significantly protected the traditional financial ecosystem from going awry.

In other words, if your Wells Fargo checking account is hacked, you have a phone number to call, and there are protection mechanisms in place to recover your funds (or otherwise make you whole.) However, if your DeFi lending pool gets rug-pulled, you’re left with basically zero recourse.

DeFi’s risks include:

- Operational risks rooted in underlying blockchains. If something happened to the underlying blockchain, like Ethereum’s, any decentralized app (like a DeFi app) would be put at risk.

- Smart contract vulnerabilities. If one of the underpinning smart contracts is written incorrectly or is otherwise exploitable, the DeFi funds are at risk of being hacked or locked. Smart contracts remove human beings from the equation, and both efficiencies or vulnerabilities can be amplified.

- Scalability challenges. For example, the majority of the DeFi ecosystem runs on the Ethereum blockchain, which is also notorious for high gas fees.

- Regulatory risks. Traditional centralized financial organizations are required to hold and maintain a wide variety of registrations, licenses, and practices to stay in good standing with their regulatory authority.

The Current State of DeFi

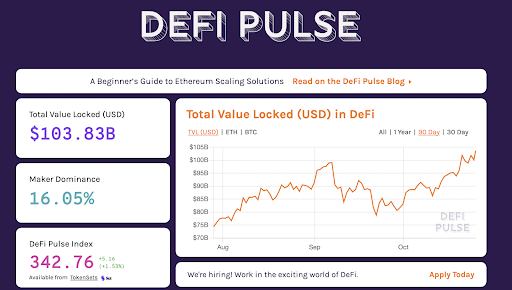

As of October 2021, popular DeFi leaderboard DeFi Pulse lists the total amount of value locked in DeFi protocols at $103.83 billion– up about 5x from October 2020 and about 16x from October 2019.

With over $100 billion floating around the DeFi ecosystem being lent and borrowed, the DeFi ecosystem boasts a strong argument for an alternative to traditional finance, but it’s far from being a competitive threat on its numbers alone.

JP Morgan, for example, alone posted revenue of $129,503 billion in 2020.

While DeFi has certainly appeared as a blip on the radar for macro players like JP Morgan, central banks, and financial regulators, it’s hardly large enough to pose a significant threat to the current financial system, let alone global financial stability. However, it’s not insignificant– DeFi’s growth rate in the past three years alone is likely helping plot a dominant trend for years to come.

While projects built on the Ethereum blockchain dominate the majority of DeFi, Ethereum isn’t the only DeFi ecosystem– Binance Smart Chain, Polygon, and Solano are among others.

Final Thoughts: Why DeFi Matters for Lawyers

In its attempt to remove humans and centralized intermediaries as much as possible, DeFi itself introduces a new heap of complexities that must be tended to by every tranche, from the everyday user to regulator.

DeFi’s growth significantly depends on its ability to navigate the traditional finance sector and, inevitably, the laws and regulations that emerge.

It’s important to keep in mind that while DeFi projects seek to decentralize, they themselves are not centralized– there is always some individual (whether named, pseudonymous, or anonymous) linked to a project.

As both innovation and regulation continue to evolve in the sector, so will the need for proper legal guidance and representation.

For example, lending protocols Compound and Aave don’t have banking licenses in the United States. Nexus Mutual, a crypto insurance product, doesn’t have an insurance license in most countries where it offers its services. DeFi tools like yearn.finance can be construed as running unlicensed investing funds.

DeFi’s numbers may pale in comparison to the traditional financial sector today, and regulators may be unsure of what to do with the rapidly evolving space today, but that won’t necessarily be the case tomorrow. Savvy founders would be keen to consult legal professionals, and lawyers would be wise to educate themselves on how to serve the needs of what could be a lucrative new clientele.