If you’re just starting out in blockchain and cryptocurrency, it’s essential to understand the industry jargon.

The terms digital assets, cryptocurrencies, and tokens are often used interchangeably, but they’re materially different in a few ways. If you’re in the legal industry, these small variations can make all the difference in a case– just wait until you get to security token classifications!

As you will inevitably notice, most cryptocurrency nomenclature can be a bit arbitrary. For example, Bitcoin is the first cryptocurrency created, and everything else is collectively known as an “altcoin (derived from ‘alternative coin’).”

Broadly speaking, a digital asset is a non-tangible asset that is created, traded, and stored in a digital format. In the context of blockchain, digital assets include cryptocurrencies, which sub-categorize into coins and tokens.

All cryptocurrencies generally exhibit the following characteristics:

- Decentralized; or at least not reliant on a central issuing authority, but depending on code to manage transactions

- Built on a blockchain or other DLT, which allows participants to enforce the system’s rules in an automated, trustless fashion

- Uses cryptography to secure the cryptocurrency’s underlying structure and network system

Coins largely differ in that they utilize their own blockchain, whereas tokens are built on top of another coin’s blockchain.

The following article explores what a cryptocurrency coin is, and why it matters for you..

Cryptocurrency Coins v. Tokens

As stated above, the primary distinction between a cryptocurrency coin and a token is that the coin has its own native blockchain, while a token utilizes the existing blockchain of another coin.

Since a coin has its own blockchain, it can operate somewhat autonomously, whereas a token must follow specific rules and guidelines set by its blockchain platform.

A coin acts much in the same ways as traditional money. It can be invested or exchanged between two parties for goods and services. Coins are usually used for peer-to-peer payments, whereas tokens are more versatile and have many uses beyond being digital cash. For example, tokens can be used to gain access to software applications (access to an app), verify identity, track products through a supply chain, represent digital art such as with non-fungible tokens (NFTs); and even to represent physical assets like art or real estate on the blockchain.

Bitcoin (BTC) and Litecoin (LTC) are both common examples of cryptocurrency coins, and they serve one purpose: peer-to-peer exchange.

Golem, in contrast, is an ERC-20 token used as a medium of exchange in a global decentralized computation network, where users can buy and sell their excess computing power, creating one massive global supercomputer.

If ERC-20 sounds foreign to you, don’t worry. It’s simply the token standard (guidelines) that a token must follow to use Ethereum’s blockchain. We’ll go over the complexities in our token guide.

Creating a blockchain from scratch isn’t an easy task, and coins are generally more difficult to create than tokens.

Coins are distributed mostly through mining, whereas tokens became popular via initial coin offerings (ICOs) in 2017, a controversial way to raise funds for new cryptocurrency networks by selling newly-created assets for established ones like Bitcoin and Ethereum.

Enough about tokens, let’s go over some of the top coins and their functions.

Bitcoin: The Flagship That Started It All

Bitcoin is the crypto that started it all.

It is regarded as the flagship of the entire cryptocurrency movement.

Its current market capitalization reached $1.1 trillion in 2021.

Bitcoin uses its blockchain to facilitate payments and digital transactions; the blockchain acts as a public ledger of all the transactions in its history. The ledger allows a party to prove they own the Bitcoin they are trying to use and help prevent tampering with the currency and other fraud. This is in contrast to a central bank to control the supply of money in an economy (e.g., the Federal Reserve and U.S. Dept. of the Treasury), or third parties like your bank and credit card issuer to verify transactions.

Bitcoin is notable because only 21 million bitcoins can ever exist, per the coins programming. This creates an element of scarcity, which makes for a unique alternative to the USD– 40% of US Dollars were printed in 2021 alone.

Ethereum: Crypto’s Software Development Sandbox

The Ethereum network (ETH) can be used to create your own personal digital tokens. Think of it as an app store that allows independent developers to release apps. Ether (ETH) can be used for transactions, but also by app developers and users to utilize the network.

As a decentralized network, Ethereum gives developers an alternative to the Apple App Store or Google Play, which take up to 30% of app profits.

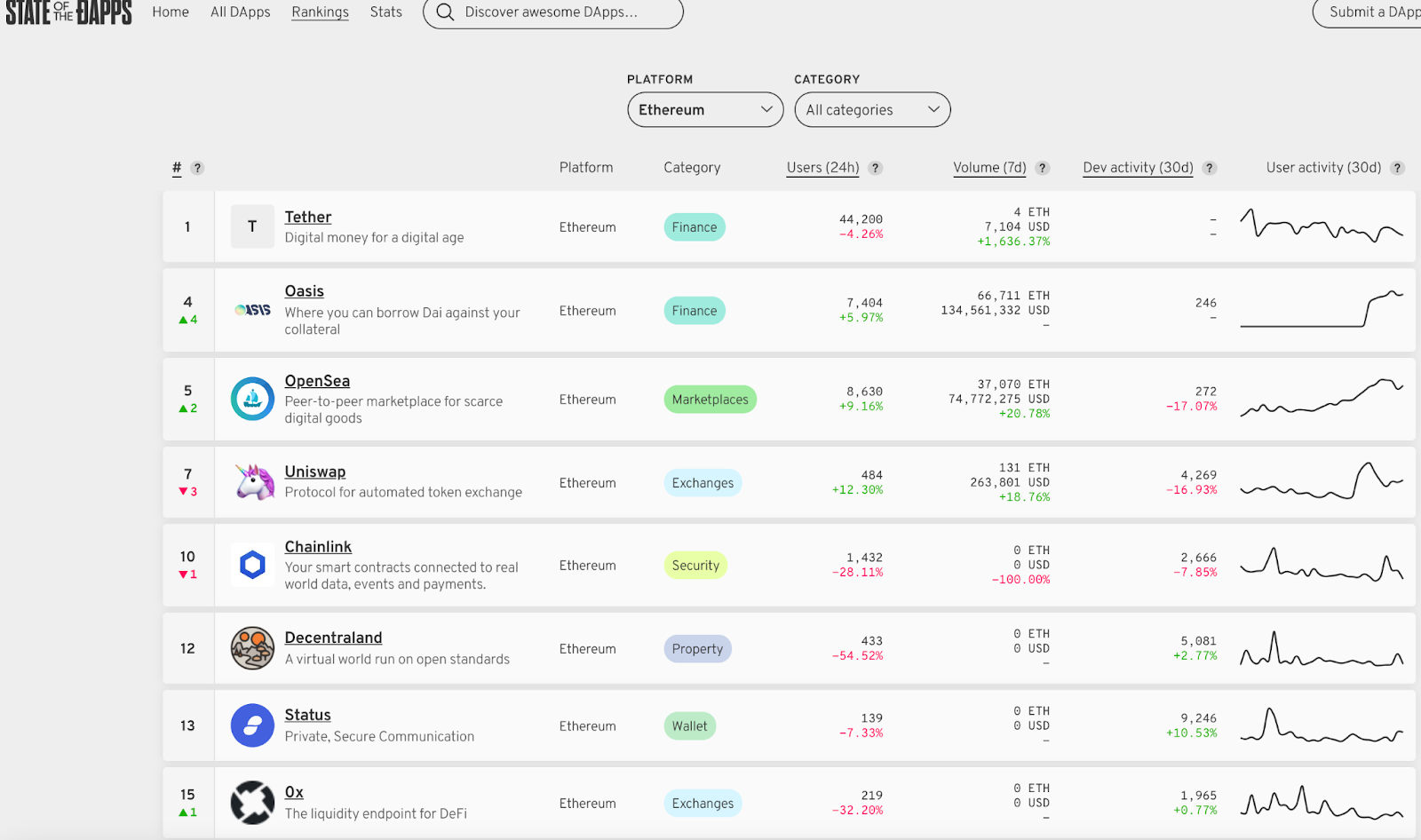

Ethereum uses blockchain technology to enable the creation of decentralized applications (dapps), each with a varied functionality, and often its own token.

For example, Tether (USDT) is an ERC-20 token that is a stablecoin; it’s value will always (in theory) equal $1; Decentraland is a virtual world that uses ERC-20 token MANA as an in-game currency. Both, and hundreds of others, are run on the Ethereum blockchain.

Creating an ERC20 token is comparatively very simple to a coin– it can cost a few dollars to deploy.

Ethereum also enables the use of smart contracts; a program that layers information onto digital transactions happening on a blockchain. Smart contracts make it possible to complete more intricate transactions than your basic exchange for a service or product.

Cardano and NEO are projects similar in scope.

Litecoin: The “Silver to Bitcoin’s Gold”

Litecoin was created in 2011 by Charlie Lee, a former Google employee to improve Bitcoin technology with shorter transaction times and lower fees.

Litecoin is a “fork” of the Bitcoin blockchain– since most cryptocurrency projects are open-source, their code can theoretically be simply copy-pasted and “forked” into another project. The code itself is unimportant; it’s the supporting network of miners, users and supporters that matters.

Forking a project is fairly common. For example, Dogecoin is a fork of Litecoin, and is similar in functionality but has a different mining mechanism.

Other examples of popular forked coins include Bitcoin Cash and Bitcoin Gold.

Monero

Founded in 2014, Monero (XMR) is one of the leading privacy-focused cryptocurrencies. It is a secure, private and untraceable fork of Bytecoin (BCN).

Monero, or “money” in Esperanto, attempts to hide user information, such as transactions and addresses. It has developed an array of privacy features that enable an impressive level of digital anonymity.

The main technology behind Monero is a balance of control over your keys and operating privately with proven security mechanisms, while also allowing malleability and development in the network.

To understand the value proposition of the Monero cryptocurrency, it’s helpful to understand certain aspects of Bitcoin. Contrary to popular belief, Bitcoin transactions aren’t anonymous, they are incredibly public. The Bitcoin ledger permanently displays both parties’ addresses and the transaction amount.

While a degree of pseudo-anonymity makes some privacy possible on the Bitcoin network (the addresses are simply an alphanumeric string), user identities can potentially be extrapolated. It’s light work for someone in the FBI to trace a Bitcoin address, especially if it has been registered on a popular centralized exchange like Coinbase or one of its many exchange alternatives.

Monero, on the other hand, completely anonymizes the transaction data. While many cryptocurrency proponents and those with libertarian ideals favor complete privacy online, others debate whether the negatives are greater than the positives.

Privacy coin advocates argue that financial privacy for individuals and organizations alike is a fundamental right. A lack of it has led to a dystopian financial environment rife with censorship, restrictions and other problematic forms of surveillance.

Critics insist that the anonymity offered by privacy coins can contribute to a lack of accountability and enable cybercrimes and black market transactions.

As a result, some exchanges have declined to list Monero; others have even delisted it entirely after being pressured by regulators. Notwithstanding, XMR remains a popular project and is still available on several platforms, which account for more than $100 million in daily transaction volume.

ZCash and Dash are similar privacy-focused projects.

Final Thoughts: Crypto Coins Take Value Digital

A cryptocurrency coin is the native asset of a blockchain network that can be traded and utilized as a medium of exchange or store of value, and this changes the value transfer game.

With some developmental savvy and elbow grease, anyone can build their own blockchain and launch a coin with predefined conditions– coin supply, issuance, consensus algorithms, and more.

Some coins aim to compete with legacy financial services, such as Visa, whereas others seek to provide an alternative to government-issued fiat currency.

With such impactful technology so within reach for modern entrepreneurs, the cryptocurrency industry will inevitably need more legal guidance and support.