Bad Relay Reviews: One Business Owner’s Response to Relay’s Closure Claims

Dear Mr. West and the team at Relay Financial,

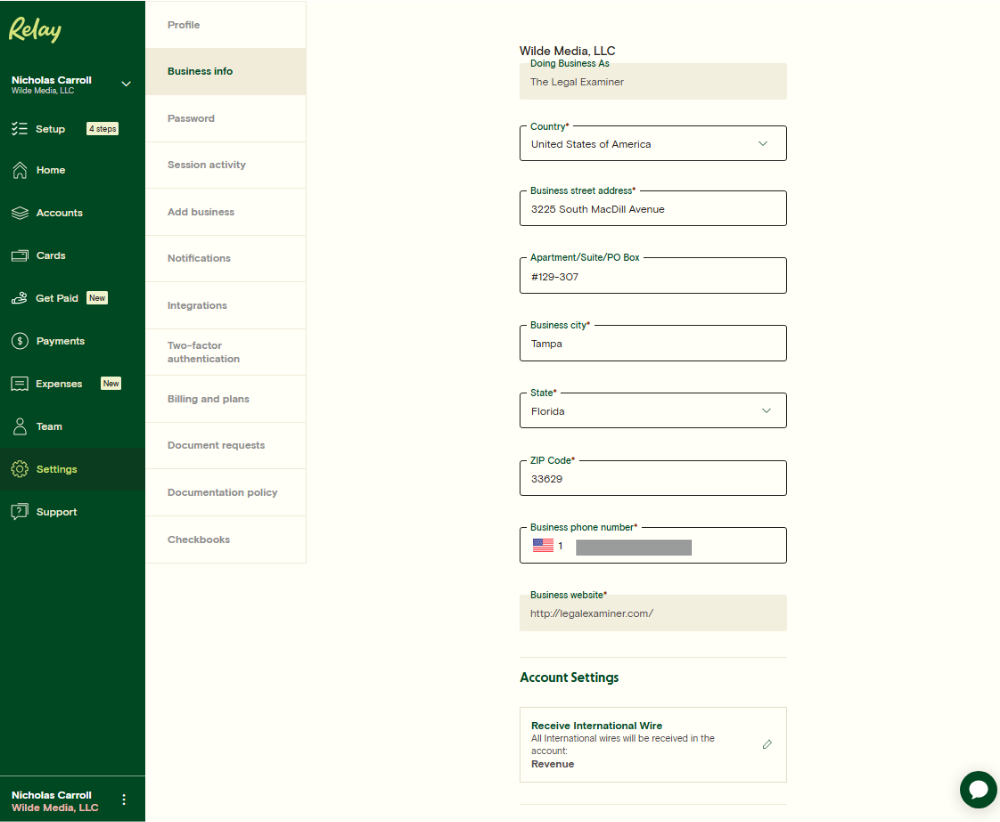

Relay promotes itself as a transparent, modern banking solution for small businesses. Earlier this year, my companies—Wilde Media, LLC (doing business as The Legal Examiner) and Claris Marketing, LLC—signed on with high hopes. At first, Relay delivered: a smooth platform, intuitive design, and a refreshing alternative to traditional banking headaches.

But as many have experienced, things don’t always stay smooth at Relay. In response to a surge of negative reviews—centered on your fraud detection policies—you, Mr. West, published “Bad Relay Reviews: let’s talk About them.” In that post, you downplayed concerns, attributing most issues to compliance misunderstandings and assuring customers that accounts are only shut down when fraud is confirmed.

I hadn’t seen that post when it went live—and even if I had, I wouldn’t have thought twice. My experience with Relay was entirely positive. I had no reason to think either of my businesses would ever trigger a fraud flag.

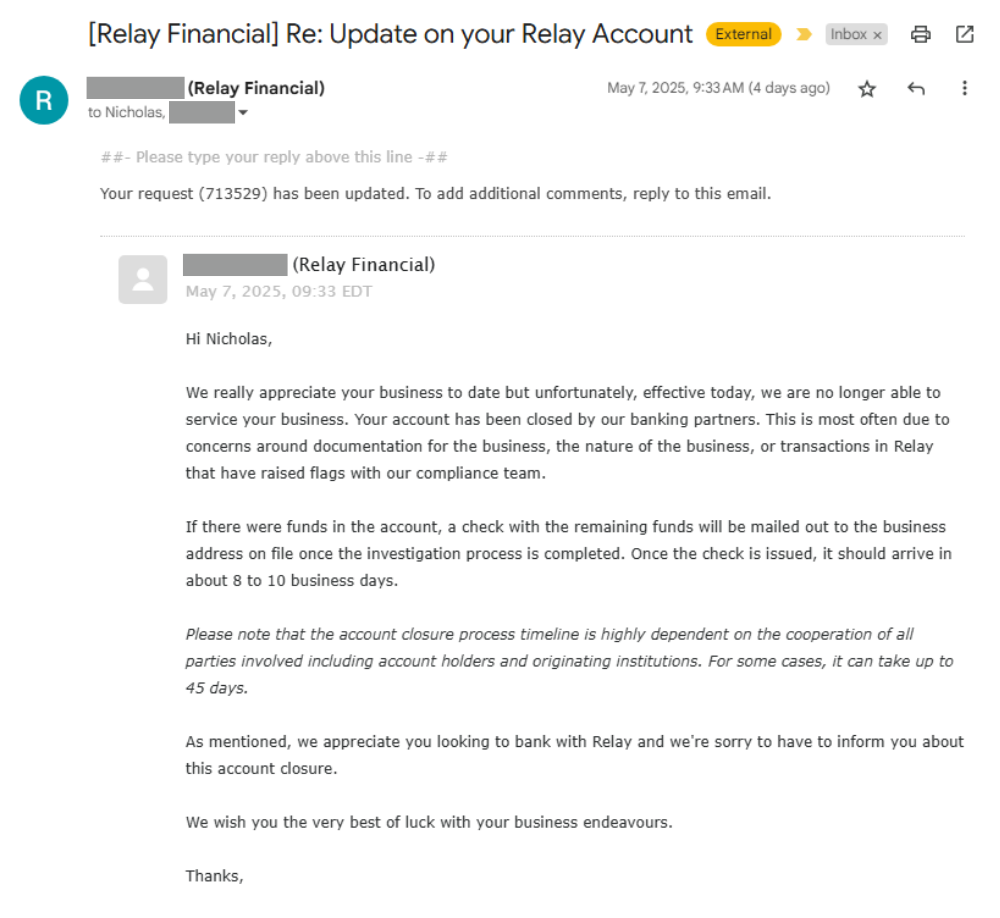

Everything was business as usual until, the day before payroll, we received a message from our payroll service provider alerting us that something was wrong. That’s when we contacted Relay and were told there was a compliance matter under review. We provided the requested information and were told it would be looked into.

The next morning, we received an email stating that one of our accounts had been closed. Soon after, we realized both accounts had been shut down. Two well-established, fully transparent businesses suddenly locked out of their own funds, apparently over routine transactions: one business paying another for monthly management services, and a standard draw to the owner.

You invited an open conversation, and while I didn’t anticipate becoming part of it, circumstances have brought me here.

I want to be clear: I genuinely enjoyed using Relay—until I couldn’t anymore. What follows isn’t a play-by-play of my experience; it’s a direct examination of where your public statements don’t align with what actually happened.

Let’s break it down:

- “…legitimate businesses considering Relay have nothing to worry about.” Claris Marketing has been operating for over twenty years, and Wilde Media—registered under its DBA “The Legal Examiner”—has been in business for more than five. Both are real, registered, and easily verified, with all relevant details documented and visible in your system.

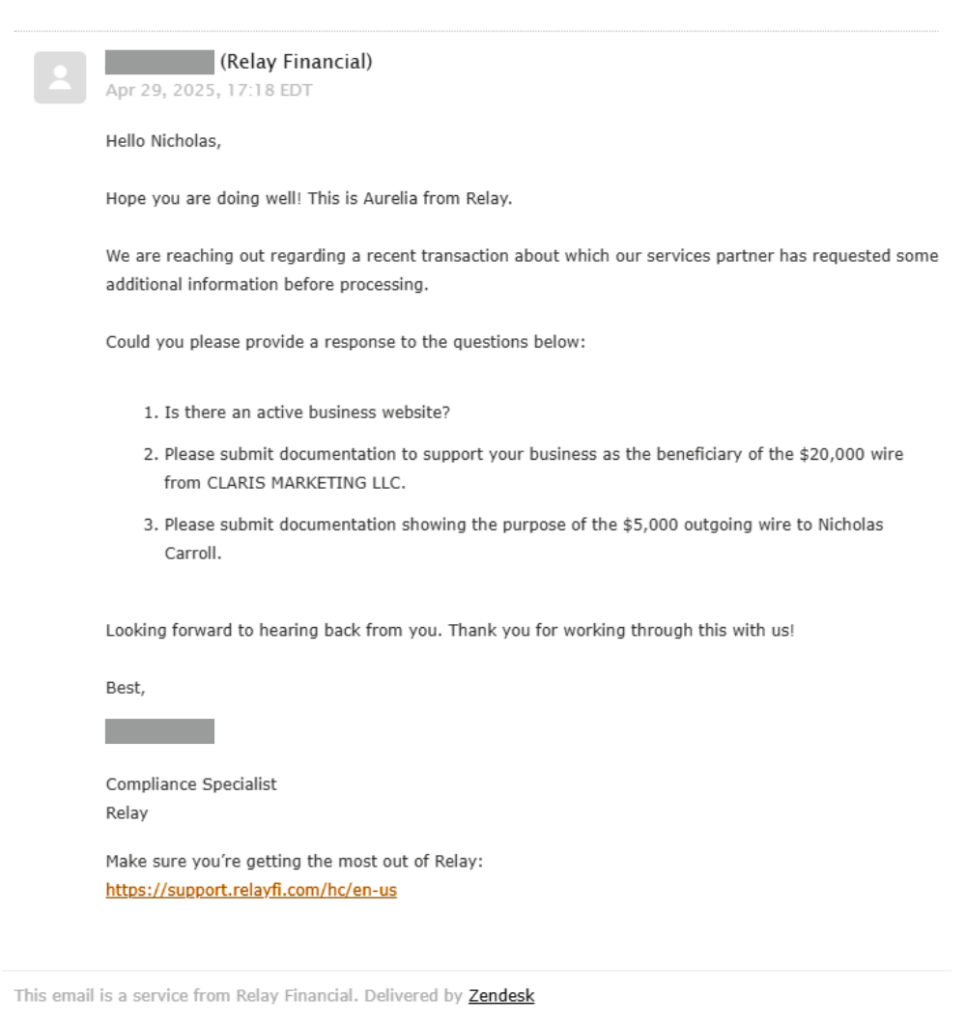

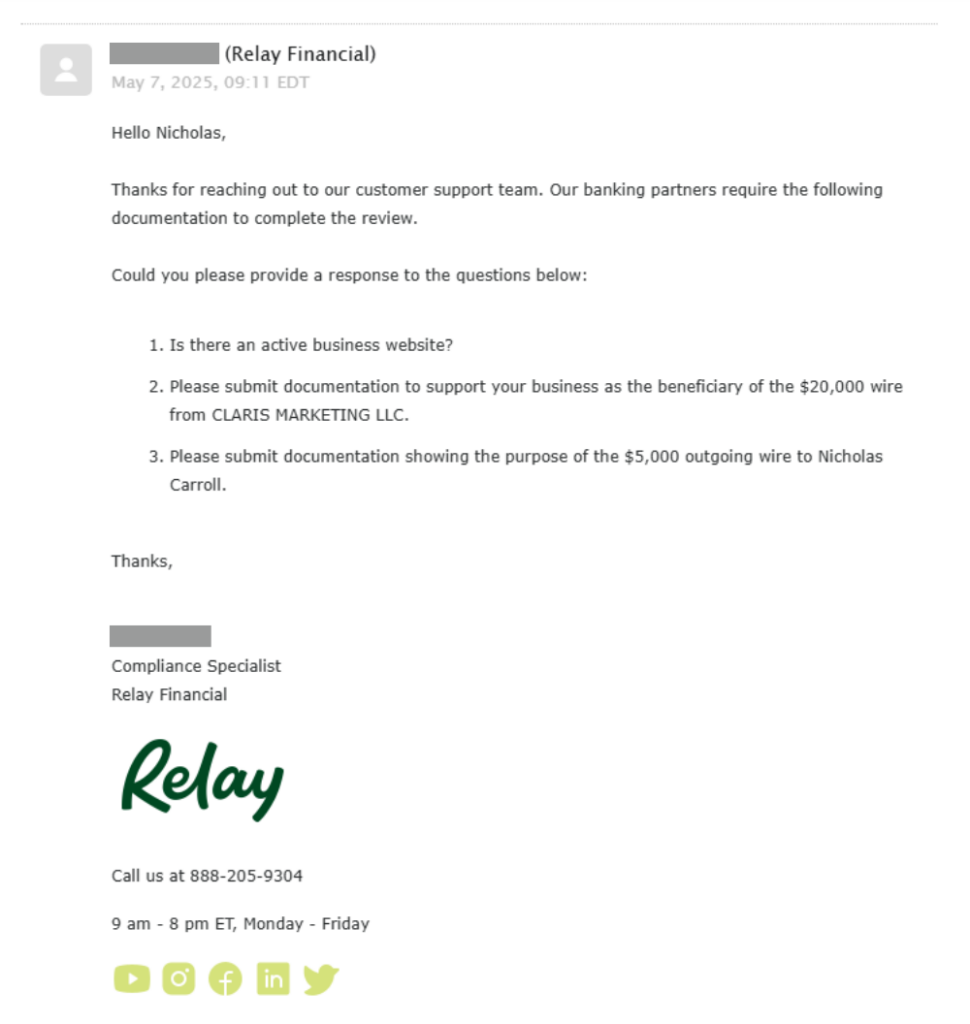

- “Relay’s always-on fraud detection monitors for signals of illegitimate activity on our platform.” In our case, the transactions flagged were a $20,000 internal transfer from Claris Marketing to Wilde Media, and a $5,000 owner’s draw—both routine, unremarkable, and fully documented. These weren’t borderline cases; they were standard business activity between known, verified entities already linked under the same Relay login. Whether or not Relay’s system found them unusual is beside the point—they weren’t. That’s not a matter of explanation. It’s a matter of design.

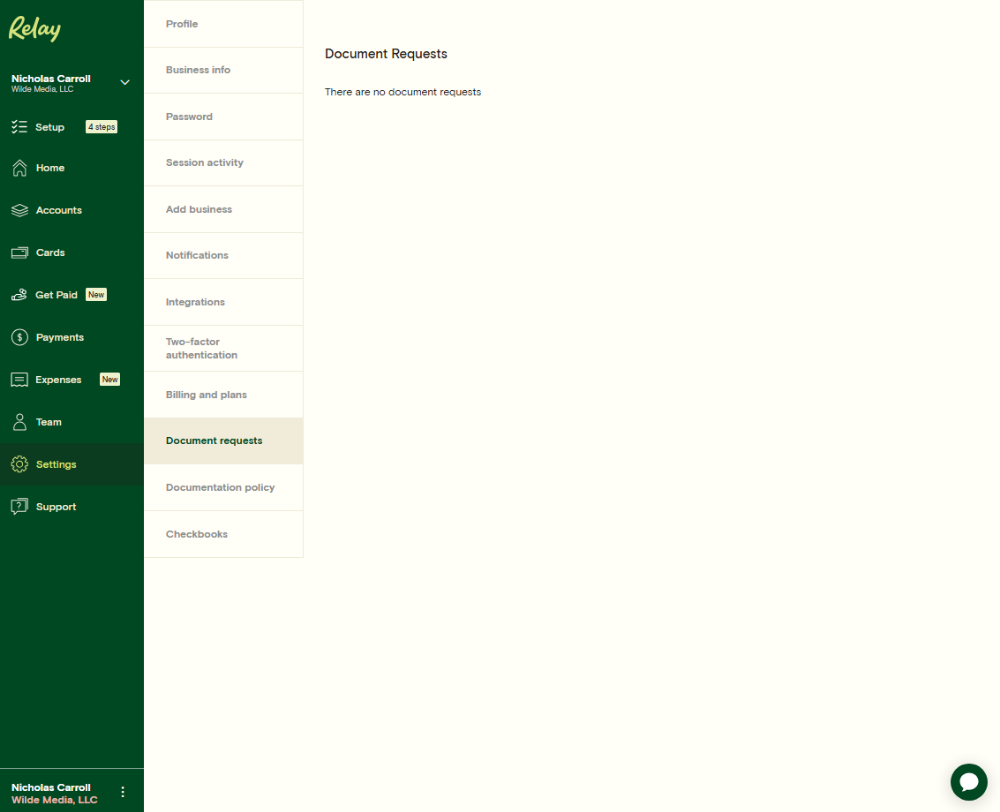

- “We issue a Request for Information (RFI) and give customers a chance to respond.” I recognize that additional information is sometimes required to verify transactions. However, relying on email to deliver critical compliance requests is inadequate for a modern banking platform. There were no in-app notifications, no alerts on the web dashboard—no clear indication within the account itself that urgent action was needed. The ‘requested documentation’ section, where such notices would logically appear, remained blank throughout. Missing the emails was easy; missing an in-account alert would not have been.

- “Freezing and closing accounts: When we don’t hear back in time—or if our signals indicate potential fraud—only then do we freeze the account. In cases where we confirm fraud, we close the account…” That sounds clear and reasonable. But what actually happened couldn’t have been more different. My accounts were never frozen. There was no meaningful review. No fraud. No verification. Just closure—after a string of emails requesting information you already had went unanswered. I want to be clear: these transactions never should have triggered anything. They weren’t suspicious, unusual, or unclear. But if Relay believed otherwise—if this truly was a fraud concern—then relying on email to communicate that risk is indefensible.

- On customer support: Your post emphasizes that Relay’s support team is responsive and resolves most inquiries quickly. In my experience, the team was indeed courteous and prompt (I was less so). However, despite multiple requests, I was never able to escalate my case or speak with anyone who had true visibility into the compliance process or authority to address it. The frontline team acknowledged my concerns but had no ability to explain or resolve the underlying issue.

- “Under no circumstances will Relay keep the outstanding balance of a closed account.”: That’s reassuring in theory. But in practice, the message was less clear. When the closure email arrived, it referenced an 8 to 10 business day timeframe for returning funds—but also warned that, under certain circumstances, it could take up to 45 days. That kind of vague window offers little clarity or confidence about when I will regain access to our funds.

The real problem: trust erodes when policy doesn’t match practice

I have deep respect for the compliance obligations that fintech companies face and understand the complexities involved. But what happened here goes beyond a simple glitch—it’s a clear example of why public assurances must be backed by reliable internal processes. When Relay tells small business owners that accounts will never be closed without confirmed fraud, we take that promise seriously. Small business owners count on it.

On paper, your policies seem solid. In practice, though, they failed my businesses at a critical moment. Closing an account is no small thing—it’s disruptive, damaging, and erodes trust in ways that are difficult to repair.

What makes this situation especially concerning is the timing. These failures occurred just six weeks after Relay publicly promised that accounts would only be closed in cases of confirmed fraud. That kind of statement raises the stakes internally. The compliance team had every reason to be more deliberate—not less. When your CEO publicly tells the world that your process is sound, the next mistake isn’t just a misstep. It’s a contradiction.

The Partners Who Stepped Up: Thank You

A huge thank you to:

Bluevine: For getting new accounts open fast and keeping everything moving.

Stripe: For transferring funds to Bluevine within 24 hours—flawless.

Gusto: For quick resolution after the payroll bounce—you made a stressful situation manageable.

American Express: For flexible support and a quick payment extension when needed.

These partners—and the people behind them—reminded us what real support looks like when it matters most.

Final Thoughts: Transparency Matters

This letter isn’t about burning bridges. It’s about accountability. Relay has the chance to bring its public messaging into alignment with its internal processes—and rebuild trust in the process.

For my part, I’m moving forward. TLE Columns—our new platform on The Legal Examiner where legal professionals can publish their own work—is now live. If you’re a legal professional looking to build your voice, expand your reach, and spark real conversations, I invite you to join us.